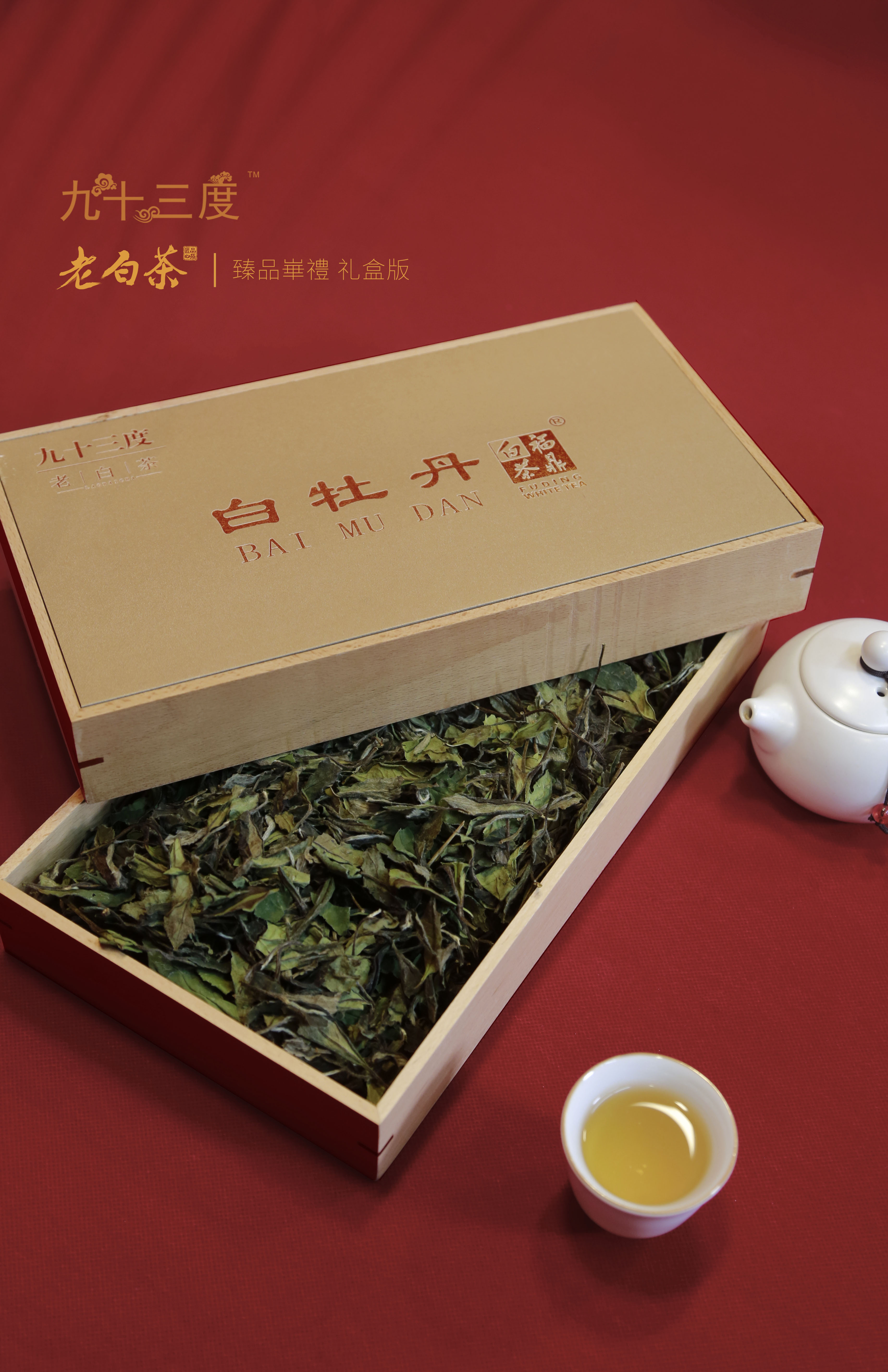

(相关资料图)

(相关资料图)

Image Source : China Visual

BEIJING, October 10 (TMTPOST) – Despite decreased mortgage interest rates, personal tax incentives, and other policies, the sluggish housing market has seen no immediate improvements in transactions.

During the week-long National Day holiday, the sales of new houses across the country fell year-on-year. The People"s Bank of China"s latest sample survey also showed that the percentage of residents bearish on housing prices rose from last quarter. The proportion of residents optimistic about housing prices hit a new low since 2009.

On Sunday, the central bank released the questionnaire survey report on urban depositors. The report shows that 14.8% of residents expect house prices to climb in the next quarter, 56.6% expect them to be unchanged, 16.3% expect them to decrease, and 12.4% are unsure about the trend.

In 2008, the U.S. real estate subprime mortgage crisis affected the world, and the percentage of residents who were bearish on real estate prices reached a maximum of 30% in the first quarter of 2009, while the rate of those who were bullish on home prices was only 15.8%. Since then, home prices have regained momentum, and the proportion of residents bullish on home prices once reached more than 45%.

However, with the absolute value of house prices increasing, the proportion of bullish residents on house prices has decreased over the years. After the current round of real estate adjustment, the latest 2022 third-quarter research shows that the proportion of residents who are bullish on home prices is only 14.8%, a record low since 2009.

Before the National Day holiday, the authorities released several policies to reduce the cost of housing and boost market confidence. These policies include lowering the interest rate of provident fund loans, implementing phased adjustment of differentiated housing credit policies, and granting tax rebates to taxpayers who have conducted transactions of their own homes within one year.

关键词: English