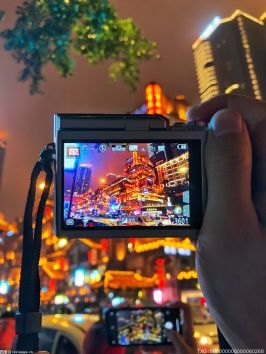

(资料图)

(资料图)

BEIJING, June 22 (TiPost)— China will step up adoption of vehicles backed by high-level self-driving technology as it ramps up fiscal stimulus for consumers spending on the clean cars.

Source: Visual China

The Ministry of Industry and Information Technology (MIIT) will launch pilot projects for on road and traffic applications of intelligent connected vehicles, carry out the demonstration of citywide vehicle-road-cloud integration, and support conditional autonomous driving, namely, commercialization of L3 or above level autonomous driving technology, said Xin Guobin, the Vice Minister of MIIT, at a press conference on Wednesday.

Companies from all over the world are welcomed to invest in China, and Beijing will support their partnership with Chinese firms on fields such as solid-state batteries and self-driving, and their cooperation to address technical difficulties, so as to accelerate tech breakthrough and industrial applications, Xin said. Xin also encourage domestic companies to expand operations beyond China, build facilities and bring their advanced technologies and products overseas.

Xin’s remark came as the day China unveiled the highly-anticipated tax break to boost electric vehicle (EV) and other green cars, as part of efforts for economic support.

The government will extend and optimize the purchase tax exemptions for the new energy vehicle (NEV), including the battery electric vehicle (BEV) and the plug-in hybrid electric vehicle (PHEV), the Ministry of Finance, the State Administration of Taxation, and MIIT announced on Wednesday. Specifically, any NEV purchased between 2014 and 2015 will be exempt from vehicle purchase tax amounting to as much as RMB 30,000 (US$4,170), and the vehicle purchase tax purchase for any NEV bought between 2026 and 2027 will be reduced by half, with a reduction cap of RMB15,000.

The tax break extension is expected to bring a total of tax exemption and reduction amounting to RMB520 billion (US$72.4 billion) from 2024 to 2027, Xu Hongcai, the Vice Minister of Finance, citing the preliminary estimates at a press on Wednesday. Xu said the tax relief was offered to bolster domestic consumption, and the cap of exemption or reduction can avoid too much consumers’ usage of tax relief on luxury cars.

The recent tax break can deemed as the tailwind for NEV sector in the long run as both the extension of tax exemption and the tax reduction have the validity period of two years, suggesting sort of policy stability, commented Cui Dongshu, secretary-general of China Passenger Car Association (CPCA). Cui estimated the annual tax exemption to be a peak of nearly RMB200 billion, which reflects the unexpectedly powerful national support by means of tax incentive.

关键词: